NTKI - Nationwide Russell 2000 Risk-Managed Income ETFįLXSX - Fidelity Flex Small Cap Index Fund This fund is a listed as child fund of Fmr Llc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value VARIABLE INSURANCE PRODUCTS FUND II - Total Market Index Portfolio Initial Class

and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value ISCG - iShares Morningstar Small-Cap Growth ETF This fund is a listed as child fund of BlackRock Inc. LINCOLN VARIABLE INSURANCE PRODUCTS TRUST - LVIP SSGA Small-Mid Cap 200 Fund Standard Class

#Beyond meat stock prediction 2021 series

PENN SERIES FUNDS INC - Small Cap Index FundĭEUTSCHE DWS INVESTMENTS VIT FUNDS - DWS Small Cap Index VIP Class A SEIAX - SIIT Multi-Asset Real Return Fund - Class A NZRO - Strategy Shares Halt Climate Change ETF UAPIX - Ultrasmall-cap Profund Investor Class Summit Partners Public Asset Management, Llc State Board Of Administration Of Florida Retirement SystemĮQ ADVISORS TRUST - EQ/Franklin Small Cap Value Managed Volatility Portfolio Class IA To prevent confusion, we now only show current owners - that is - owners that have filed within the last year.

#Beyond meat stock prediction 2021 full

However, funds sometimes exit positions without submitting a closing filing (ie, they wind down), so displaying the full history sometimes resulted in confusion about the current ownership. In general, entities that are required to file 13D/G filings must file at least annually before submitting a closing filing. Previously, we were showing the full history of 13D/G filings. Note: As of May 16, 2021, we no longer show owners that have not filed a 13D/G within the last year. This means that share ownership of 13D/G filings and 13F filings are oftentimes not directly comparable, so we present them separately. This results in situations where an investor may file a 13D/G reporting one value for the total shares (representing all the shares owned by the investor group), but then file a 13F reporting a different value for the total shares (representing strictly their own ownership).

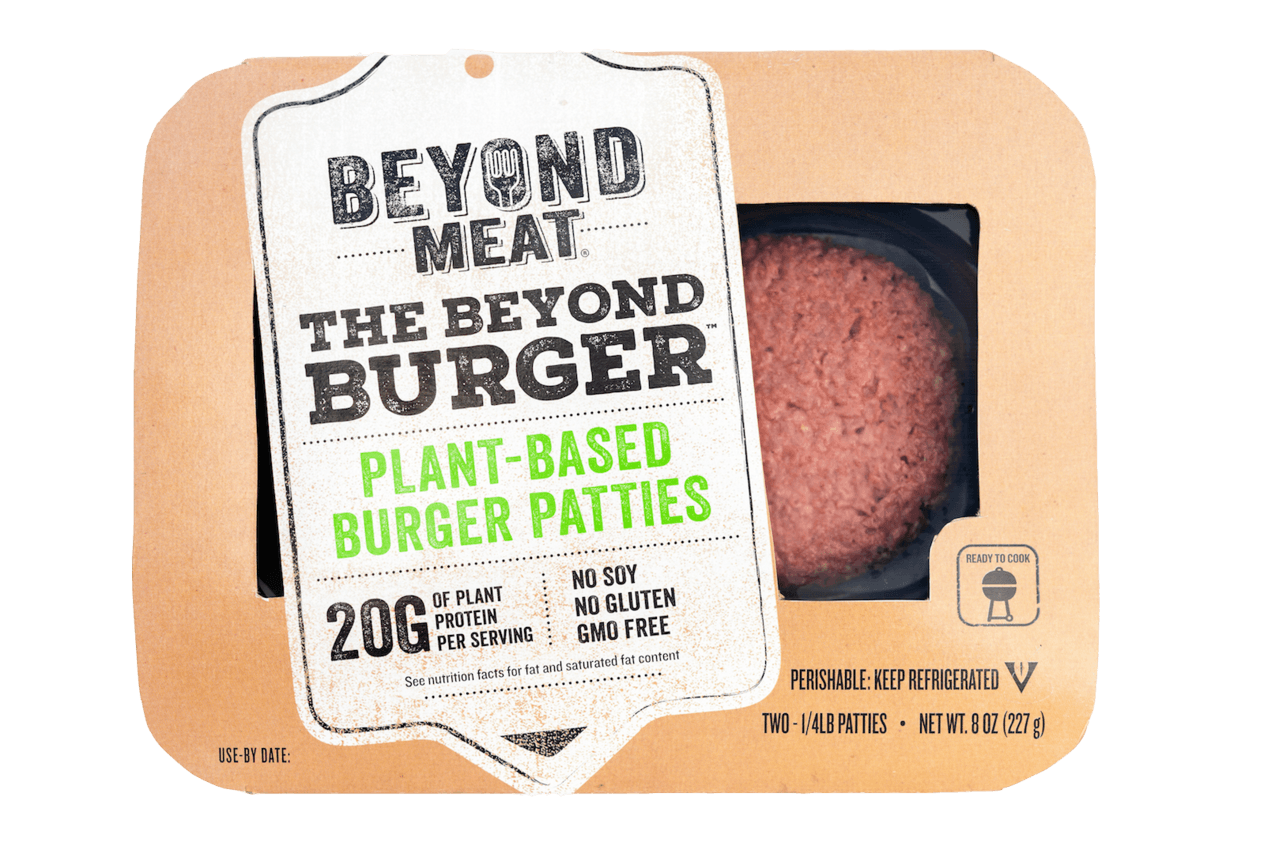

13D/G filings can be filed by groups of investors (with one leading), whereas 13F filings cannot. We present 13D/G filings separately from the 13F filings because of the different treatement by the SEC. The share price as of Octois 8.17 / share. Schedule 13G indicates a passive investment of over 5%. The Schedule 13D indicates that the investor holds (or held) more than 5% of the company and intends (or intended) to actively pursue a change in business strategy. Major shareholders can include individual investors, mutual funds, hedge funds, or institutions. īeyond Meat Inc (NASDAQ:BYND) institutional ownership structure shows current positions in the company by institutions and funds, as well as latest changes in position size. Vanguard Group Inc, Parkwood LLC, BlackRock Inc., Wolverine Asset Management Llc, Whitebox Advisors Llc, Susquehanna International Group, Llp, Susquehanna International Group, Llp, Group One Trading, L.p., VTSMX - Vanguard Total Stock Market Index Fund Investor Shares, and NAESX - Vanguard Small-Cap Index Fund Investor Shares. These institutions hold a total of 31,555,373 shares. If you are good with personal finance and are looking to invest, you will find the Beyond Meat on NASDAQ stock exchange.382 institutional owners and shareholders that have filed 13D/G or 13F forms with the Securities Exchange Commission (SEC). Always read up on optimal investment strategies if you are new to investing. Trading in bear markets is always harder so you might want to avoid these stocks if you are not a veteran. Since this share has a negative outlook we recommend looking for other projects instead to build a portfolio. Our Ai stock analyst implies that there will be a negative trend in the future and the BYND shares are not a good investment for making money. Currently there seems to be a trend where stocks in the Consumer Defensive Manufacturing sector(s) are not very popular in this period. According to present data Beyond Meat's BYND shares and potentially its market environment have been in bearish cycle last 12 months (if exists). Recommendations: Buy or sell Beyond Meat stock? Wall Street Stock Market & Finance report, prediction for the future: You'll find the Beyond Meat share forecasts, stock quote and buy / sell signals below.

0 kommentar(er)

0 kommentar(er)